2024 Ira Tax Limit

2024 Ira Tax Limit. The 2024 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly. What are the 2024 ira contribution limits?

The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. What are the benefits of a traditional ira?

If You Are Age 50 Or Over By December 31, The Catch.

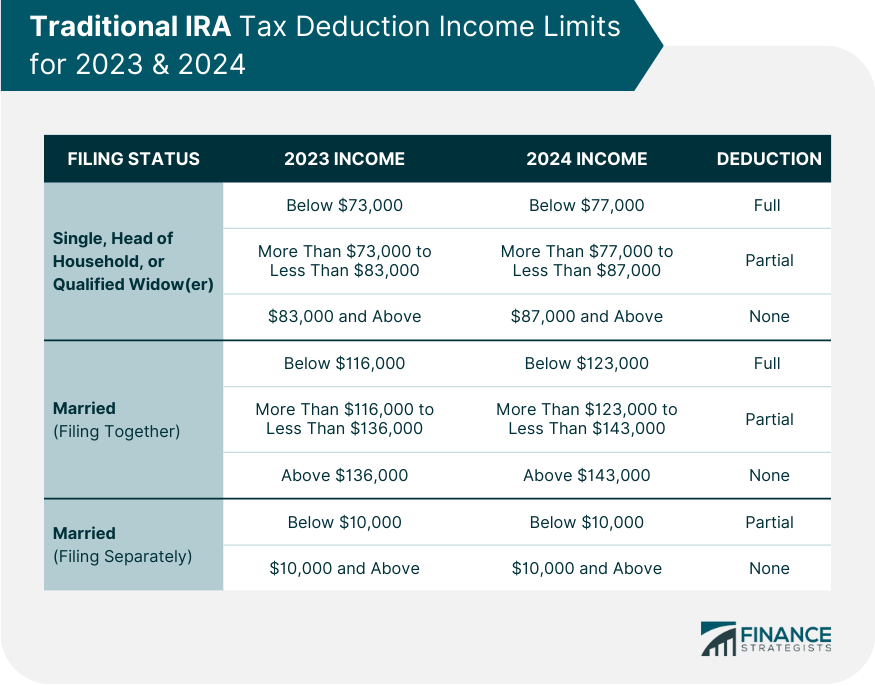

The deduction may be limited if you or your spouse is covered by a retirement plan at work and your income exceeds.

The Contribution Limit For Individual Retirement Accounts (Iras) For The 2024 Tax Year Is $7,000.

There’s about five months left in 2024, so if you hope to save $7,000 in your ira this year, you’d need to set aside $1,400 per month through december.

2024 Ira Tax Limit Images References :

Source: amandistevena.pages.dev

Source: amandistevena.pages.dev

Simple Ira 2024 Contribution Limit Irs Zarla Maureen, There's about five months left in 2024, so if you hope to save $7,000 in your ira this year, you'd need to set aside $1,400 per month through december. The annual contributions limit for traditional iras and roth iras was $7,000 for 2024, rising from $6,500 for 2023.

Source: emelinewariana.pages.dev

Source: emelinewariana.pages.dev

Maximum Home Office Deduction 2024 Irs Vanya Jeanelle, Notable 2024 ira updates include: Income tax benefits from budget 2024:

Source: simonnewblake.pages.dev

Source: simonnewblake.pages.dev

Irs Limits For 2024 Melva Sosanna, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. Notable 2024 ira updates include:

Source: directedira.com

Source: directedira.com

HSA Archives SelfDirect your IRA, If you are age 50 or over by december 31, the catch. Up to the $7,000 limit:

Source: www.msn.com

Source: www.msn.com

SIMPLE IRA Contribution Limits for 2024, You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira. $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, The annual contributions limit for traditional iras and roth iras was $7,000 for 2024, rising from $6,500 for 2023. What are the disadvantages of a traditional ira?

Source: koriqmaryellen.pages.dev

Source: koriqmaryellen.pages.dev

Roth Ira Max 2024 Minda Sybilla, For senior citizens (above 60 years but below 80 years) and super senior. In 2024, this increases to $7,000 or $8,000 if you're age 50+.

Source: fity.club

Source: fity.club

Year End Look At Ira Amounts Limits And Deadlines, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. There's about five months left in 2024, so if you hope to save $7,000 in your ira this year, you'd need to set aside $1,400 per month through december.

Source: merriewranee.pages.dev

Source: merriewranee.pages.dev

Ira Contribution Phase Out 2024 Sonni Celestyn, 2024 roth ira contribution limits and income limits. The limit for ira contributions has been raised to $7,000 for 2024, up from the previous $6,500.

Source: geneqcaitlin.pages.dev

Source: geneqcaitlin.pages.dev

Ira Limits 2024 For Simple Ira Addia Malorie, Up to the $7,000 limit: What are the benefits of a traditional ira?

In The Old Tax Regime, The Basic Exemption Limit For Individuals Below 60 Years Is Rs 2.5 Lakh.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.

The Roth Ira Contribution Limit For 2024 Is $7,000 For Those Under 50, And $8,000 For Those 50 And Older.

The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you’re.

Category: 2024